From Our Office in Las Vegas, We Help Clients With:

Estate Planning

We assess your situation and help you understand the options you have. From drafting a will, trust, or power of attorney, we put together a strategy to help protect your family. It is also important to consider your wishes for long-term care.

Elder Law

We can help you understand options for protecting assets from catastrophic health care costs or living expenses through elder law care planning, Medicaid, guardianship, and veteran’s benefits.

Guardianship

Probate

Probate can be overwhelming and complicated. We help you navigate through the probate process. We also work with many families who live in other states and need a Nevada probate lawyer to help.

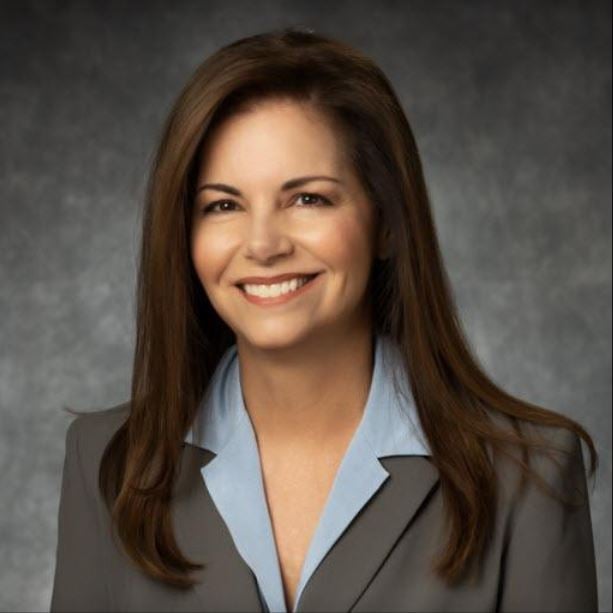

Over Two Decades Of Experience In Estate Planning, Elder Law And Probate In Nevada

Our founding attorney, Kim Boyer, has been helping individuals and families across Nevada for more than 25 years. Kim, along with our dedicated staff, understand what it feels like to lose someone important. Kim is certified as an Elder Law Attorney by the National Elder Law Foundation. We are focused on providing you with a clear picture of all your options, and immediately getting to work once you have determined what is best for your situation.

We know that you will have questions, and we will do our best to give you detailed answers that actually give you the knowledge you need to resolve your specific concerns. You can rely upon us for help and guidance at each step of the process. Whether you are just getting started with an estate plan or need help with an elder law issue or need help with the probate process, our team is prepared to provide you with compassionate, considerate and efficient representation at all times.

Representing In State And Out-Of-State Clients With Nevada Probate Concerns

A number of our clients are located outside of Nevada but need assistance with a Nevada probate matter. We regularly handle these cases, and know what to do to make the process work for you and your family at a difficult time. We know resources in Nevada to effectively safeguard real property, such as help with stopping a foreclosure, evicting squatters, auctioning personal property, appraisals, and biohazard clean-up. We also assist in multi-state cases, handling of businesses, and tax issues.

We help you every step of the way so you will know what to do when terminating existing accounts, opening an estate bank account, handling creditors, handling taxes, overseeing asset distribution, and closing the estate. We provide you with the Nevada Personal Representative Guide: A step-by-step guide to estate administration in Nevada, which gives you essential information for handling estates of any size.

Compassionate Help With Nevada Elder Law

Boyer Law Group, based in Las Vegas, understands how hard it is when an elderly loved one becomes incapacitated. It can be difficult to focus on issues that need to be addressed when your loved one has Alzheimer’s or dementia, suffers a stroke, becomes victim to fraudulent schemes, or is otherwise showing signs of incapacity. We have had the honor to help guide many families over twenty five years through these issues.

Things can seem overwhelming and complicated, and we are here to help you with planning for your loved one’s future. Our elder law attorney can help with all of the issues related to the situation, including navigating the guardianship process, if necessary. We also work with many families who live in other states and need a lawyer in Nevada to help with various issues related to their loved ones located in the state.

Call Us Today For More Information About Your Situation

To take the first step toward sorting out your concerns, speak with an experienced attorney at our firm today. Call our Las Vegas office at 702-255-2000 or reach us through our online contact form. If you are curious about what your first meeting with us will entail, please visit our page on what you can expect.